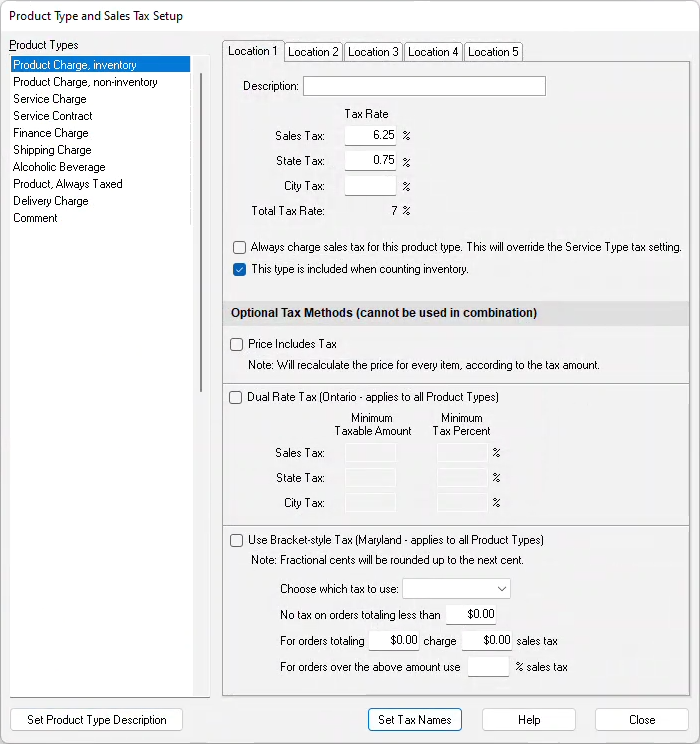

This list is not user-definable and can be found in the Point of Success Office Manager system in the Tools menu under the heading "Accounting and Business Information." Click the sales tax underlined blue hyperlink to access this list.

The separated tax rate is indicated in this window: Tax 1, Tax 2, and Tax 3 tax rates (enter the name for each tax rate using the "Set Tax Names" button). Together, they add up to the total tax rate calculated and charged on each order. Enter the values in these fields as percentages. For example, if the desired sales tax rate is 7.8%, simply key the amount 7.8 in the field. The number represents a percentage but the percent (%) sign is not necessary.

Tax location means the tax rate where the tax payer (customer) lives. Tax rates for adjacent municipalities are recorded in these locations and charged according to where the customer lives, not where the merchant is.

Price Includes Tax calculates backs tax out of each item sold. So, if the price of the item is $3.00 including tax, then when it is ordered its price will be reduced by the tax amount and the tax will be placed in its own calculation and reported as tax rather than revenue. When setting up products that include tax, set their price as if the tax were already included.

Special tax consideration is built in to accommodate Maryland, Ohio, and Ontario, CA. Other municipalities who impose peculiar tax requirements may be able to use these methods as well. They are not limited by location. Rather, they are designated as such because these municipalities first introduced the requirement.

If there are products that need to be charged sales tax regardless of other settings in the program, the 'Always charge sales tax for this product type. This will override the Service Type tax setting.' is checked. These item types will always be taxed.

Minimum Tax Amount - This number is the amount of the order under which no tax should be charged. If taxes are not charged on items less than $.10, this will preclude the tax from being charged. If a requirement that $4.00 tickets not be charged tax exists, the amount in this field should be set to $4.00.

There is a check box titled This type is included when counting inventory that is implemented with the inventory add-on to Point of Success.